KuCoin

Kucoin Review 2023: An Expert's Comprehensive Analysis

4.1

3.75

4.5

4

4

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

Great coverage in multiple countries

Robust selection of tokens, with many unique selections

Discounts on certain tokens and fees

Advanced features - margin trading and future trading

Cons

Some of the coins listed are not as established, so may be at higher risk

The exchange is not licensed in the USA

Suffered a major hacking incident back in 2020

Key Takeaways

Origins

Introduction

Known as “the people’s exchange” Kucoin is a strong contender in the battle for crypto exchange supremacy.

Emerging like many others during the 2017 bull run, the company is renowned for its extensive coverage of many countries, multi-language services, and supposed 24/7 support.

But is the company as user-friendly as it claims - or is it sweeping some controversies under the rug? Regardless, fear not, CoinScan has got the full breakdown. So join us as we ask, KuCoin, who-coin?

History

While it’s not as much a household name as Coinbase, KuCoin is still a prevalent and well-known centralized exchange (CEX).

Founded and originally headquartered in Singapore by the relatively enigmatic CEO (at the time) Michael Gan and seven key associates, the company was first breathed to life in 2013 and went through 5 years of development and testing before fully launching on September 15, 2017.

According to internet lore, Michael was previously a miner of Bitcoin in 2012. However, he found it difficult to trade on Mt. Gox (the primary Bitcoin exchange at the time). In response, he and his primary partner – Eric Don – got to work on creating an exchange that all could easily use.

In early 2018 the exchange managed to raise a healthy $20 million USD series A financial injection by Matrix Partners, NGC Ventures, Karnika Yashwant and IDG Capital, and in 2021 a substantial further investment of $150 million, which added new partners Circle Ventures and Jump Crypto into the mix.

The exchange started to branch out at this point, introducing its research department – KuCoin Spotlight – which scourers the internet and seeks out the highest quality start-ups to aid their growth, utilizing its own launchpad (to date, it has helped launched 20 new projects such as Lusko and Polkadex).

March 2020 saw a change within Kucoin, as Johnny Lyu took over the position of CEO and to this day still currently is responsible over Kucoin global and all its ventures.

In addition, earlier in 2022, they launched Windvane, their very own NFT marketplace. Since its inception, KuCoin has risen steadily to become one of the top 5 cryptocurrency exchanges in the world – usable in over 200 countries worldwide - 60 more than the industry leader Binance.

User Experience

Ease of Use and Design

KuCoin is quite iconic with its vivid green and white palette. While its design is smart and clean it can be a bit overwhelming for new users simply due to the sheer number of options.

For instance, the toolbar on the primary site features many industry terms that are simply too complex for anyone other than advanced cryptocurrency traders to make sense of.

There is also KuCoin Academy, a series of articles on Medium that new traders can make use of (although whether they were actually created by KuCoin or not is anyone’s guess).

Moreover, the app and the desktop versions are identical in function, which means there is no duplication of effort required when moving from one version to the other, which is no easy development feat.

In addition, thanks to having suitable app and desktop versions, users can trade anywhere at any time - whether that be via the App Store, iOS App, Google Play or Android APK - leading Forbes to name KuCoin as one of the “Best Crypto Exchanges in 2021.”

In 2022, the Ascent dubbed KuCoin the “Best Crypto App for Enthusiasts.” However, in contrast to these accolades the Fiat onboarding process of the site certainly won’t be winning any awards soon.

Reported to be clunky at best and outright unusable at worst, many cards are apparently not compatible for use on the site. Therefore, many users report that it is often necessary to use another exchange to buy cryptocurrency, and transfer over – which effectively defeats its primary purpose.

It is important to note here however that this issue is dependent on certain locations and banks.

Lastly, a newly added element which all customers can benefit from is the platform’s News section, ideal for educating both new and old customers alike.

Due to cryptocurrency being so volatile, there’s certainly never a shortage of news and opinion pieces floating around the space, and this represents a great way for users to learn of current affairs directly on the site itself.

Usage and Popularity

As one of the top 5 crypto exchanges in the world KuCoin is certainly popular, and currently has over 10 million users worldwide across 200 different countries.

One of the critical features that set it apart from the competition however, is the sheer number of coins available on the site. The exchange currently holds 731 tokens (over double that of Binance) across 1272 trading pairs, and on these they hit a pretty healthy 24-hour trading volume of $468,527,651 at the time of writing.

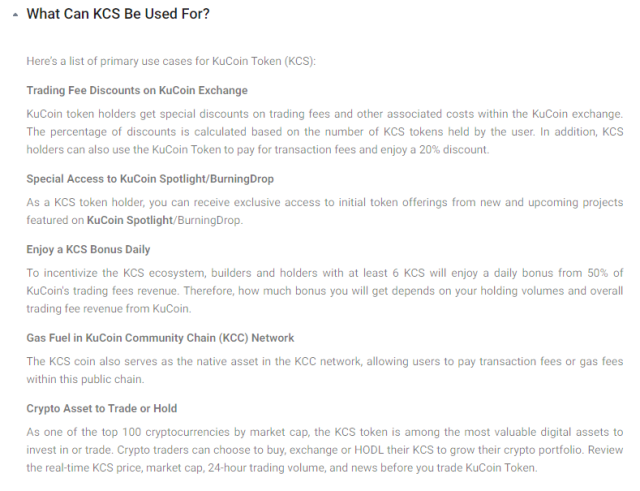

Its most active trading pair is BTC/USDT with a 24-hour trading volume of $102,120,729.19 - despite having its own trading coin KCS, which is issued as an ERC-20 token that runs on the Ethereum network.

Another element that separates the exchange from its contemporaries is that whilst members can provide a KYC to have ‘full’ access, this is not required, as long as the user accepts certain caveats, such as limits on trading, leverage, and withdrawals.

The following are accessible without KYC:

This is far more than many other exchanges, but is admittedly a lot for a new trader to wrap their head around.

In addition, there are smaller market cap coins traders simply can’t access on other exchanges, which is a great positive for those looking to branch out from the mainstream, but might also be a negative due to their inherent volatility.

Customer Support

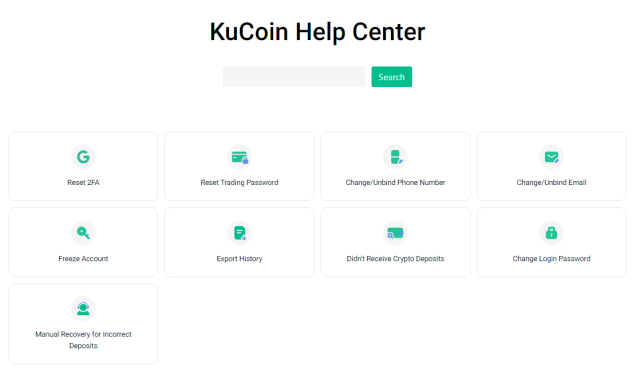

When it comes to crypto, things can get complicated and it’s easy for issues to arise. As such, a robust help system is expected of major exchanges.

To this end, KuCoin certainly steps up to the plate, with an extremely useful help section covering most areas of concern, which features numerous articles on all the hot topics, such as trading, deposits and withdrawals, and passwords, among many others.

There is a search bar for when the query isn’t straightforward, and even a support request function for when the questions is more complicated.

There is also apparently a 24/7 live system for those who need help more urgently, but - despite the exchange announcing that it's been upgraded in order to issue better customer service - users have reported that it is typically unavailable and they instead have to send in a support request.

It is also important to note that when digging around it is possible to find a ‘supposed’ customer service number.

Upon a quick google search the same phone number appears to be linked to multiple other exchanges, more than likely making it some form of high cost third party company with no real connection to KuCoin.

In addition, customer service hasn’t always shined for the exchange, with many users reporting slow response times to concerns and queries, and unhelpful responses when the answers do come. So it seems like the company has a little more work to do in this area.

Fees and Promotions

Fees

KuCoin shines in the fees department. The exchange offers competitively low trading fees compared to its rivals– and as such users can expect to pay around 0.10% and 0.08% depending on the trade (Spot and Futures, respectively).

Interestingly, also similar to sites like Binance and OKX, the cost of fees depends on users' 'level’ - and whether or not they are fortunate enough to be VIPs.

Consequently, KuCoin’s trading fees are incredibly competitive. Like its contemporaries, the exchange implements a maker/taker fee structure, and thus, investors pay contrasting fees depending on whether or not their order is considered a marker or a taker.

The level of the maker/takes costs change depending on the coin type. The exchange sorts the class of the coins into Classes; A, B, and C.

The most popular cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), are in Class A, and the maker/taker range is 0.1% for both types of fees.

However, more obscure coins – such as Love Coin (LOVE) for example – fall under Class B, with a maker/taker fee of around 0.2% for both. These can be considered 'mid ranged' tokens with large liquidity pools and 8 figure market caps.

Even lesser-known tokens (of which not many are listed) are categorized under Class C due to having less than a $1M market caps. For these more volatile assets, they understandably have maker/taker fees of 0.3%.

Investors can also receive discounts of up to 20% depending on their average monthly holdings of KuCoin’s native token (KCS) or their monthly trading volume.

Another tip of the hat goes to the fact that KuCoin does not charge deposit fees when sending crypto assets into the platform, which is rare.

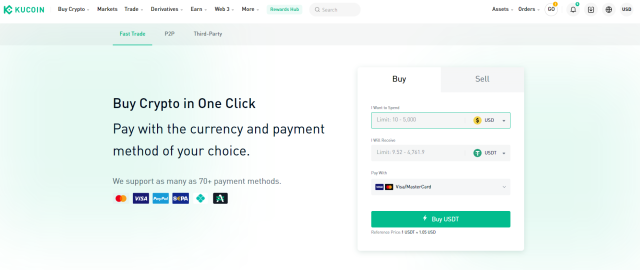

Moreover, when investors want to buy crypto using fiat currencies, the exchange provides numerous options, including “Fast Trade”, “P2P”, and third-party payment services – all of which have their own transaction charges, from 3% - 7%.

Comparison

KuCoin has a lot of great attributes that make it a strong cryptocurrency exchange, but in this industry there are always other options for anything and everything.

Enter Gate.io, a very strong exchange like KuCoin that also hosts a plethora of different cryptocurrencies for users to dabble in. While KuCoin has a staggering 755 different coins available, Gate.io offers an earth shattering 1,153 coins to choose from!

If you are truly a "degen" looking for small marketcap tokens, Gate.io will surely please you more with it's massive selection. It's worth noting that KuCoin does generate almost double the daily volume that Gate.io brings in, so if you're looking for more sound plays with more volume, KuCoin should be your pick.

Lastly, a strong factor here is that while both exchanges are VERY similar, KuCoin has an advantage in the accessibility department. You do not need to submit KYC information to use KuCoin unlike Gate.io (and most exchanges). So if you're a fan of privacy and decentralization, it's an obvious choice here.

Safety Essentials

Security

Despite the number of security protocols many crypto exchanges implement, many still fall victim to fraudulent activity at least once in their lifetime.

Look at Binance, for instance; despite being one of the largest crypto exchanges worldwide, it was hacked for a whopping $570 million in October 2022. KuCoin is no different and was also hacked on September 26 last year, with damages amounting to more than $180M worth of stolen cryptocurrencies in total.

There was a silver-lining to this event however, as it caused KuCoin to beef up their security to extremely high levels, ensuring that their platform was protected in all the best ways possible – and it hasn’t been successfully hacked since.

KuCoin has a security team constantly on board to protect users’ privacy and assets from infringement, for instance, and to push for further protection, the exchange continuously improves its security-related mechanisms, such as its login IP feature, which automatically triggers and warns the user when a new account attempts to log in.

Another fantastic security tool KuCoin employs is its anti-phishing phrase. Users can add a safety phrase to their accounts to avoid phishing emails and websites.

Then, they will receive an email with the words when logging in. If it is incorrect or not displayed properly, users will know that it’s a phishing site rather than the actual website and will (hopefully) not proceed with any further interactions.

Moreover, another crucial security feature KuCoin includes is withdrawal limits of around 1 BTC daily (around $18k USD at the time of writing). So, if scammers were somehow able to get hold of user’s account information, they can’t wipe them clean by taking all of their finances at once. (However, it is still a significant amount of money to be stolen by most mere mortal standards).

Also an important note is that KuCoin will also take to Twitter to warn users of any fraudulent activity as soon as it’s aware, so, it is worth adding their accounts to stay up to date

Controversy

Throughout the years, KuCoin has remained among one of the more secure crypto exchanges, boasting bank-level security on its wallets.

Nevertheless, since losing around $150 million from a major hack last year (as mentioned earlier), there remains some controversy about the exchange’s level of protection – and whether it’s good enough for the everyday user (thankfully, almost all stolen assets were recovered through insurance and returned to users).

KuCoin also has an insurance fund pool that grows from liquidations, and can be found under the Insurance Funds Records section.

Another issue, which raised many controversial concerns, included a notice published by KuCoin at the beginning of this year.

KuCoin took to its website and social accounts, including Telegram, to warn users that criminals are pretending to be the business team behind the exchange - getting users to sign fake listing agreements to receive transfers of digital assets to a fraudulent deposit address.

In addition, the exchange supplied victims of the hack with the email address of its security team, so members could easily reach out for the necessary help and extra security.

Furthermore, in April 2020, the Singapore Court also locked the crypto exchanges web domain to prevent KuCoin from switching its assets, including its website, from the country.

Following the ban, the legal entity behind KuCoin and the owner of the KuCoin.com domain resigned – raising many concerns from users who took to socials, like Reddit, to try and understand the company’s corporate structure. However, the thought process behind the former members remains unclear.

KuCoin is also not licensed in the United States. The reasons for the ban from the US Government include lacking the license for such citizens, alongside the necessary Know-Your-Customer (KYC) process.

Nevertheless, that does not mean users in the US cannot use KuCoin – they can still access and use the platform. However, the process becomes more complicated, accompanying risks due to not having KYC disclosures other users have – necessary for reducing crime and money laundering.

Proof of Reserves

This important metric is something that many exchanges are taking very seriously, especially considering the large amount of controversy surrounding what they do with user funds since the unexpected collapse of FTX.

Since the bankruptcy, exchanges have been pushing to publish proof of reserves throughout the past month to prevent users from leaving the exchange following the damaged reputation.

In December 2022, KuCoin released its proof of reserves report, issued by the third-party auditor Mazars. Surpassingly, the report concluded that KuCoin’s exchange’s Bitcoin, USDT, Ether and USDC reserves are overcollateralized.

The BTC reserve had a collateralization ratio of 101%, whereas stablecoins USDT and USDC were overcollateralized by 102% and 101%.

On top of that, KuCoin has also launched a Proof of Reserves website that allows users to verify their assets on the Merkle Tree, showing that the exchange values user trust and that the necessary measures are set firmly in place.

Conclusion

KuCoin has numerous advantages compared to other cryptocurrency marketplaces. One of the most prominent is that it boasts more than 700 cryptocurrencies – a lot more than many of its contemporaries.

New and experienced investors can find any cryptocurrency they are interested in purchasing or trading.

However, the less developed coins should be traded with caution, even though they are on an exchange it doesn't guarantee a safe investment.

Although the platform offers standard, all-important security measures, such as anti-phishing phrases, identity verification and more, one of the primary drawbacks of KuCoin is the lack of a US license, which many exchange giants, like Coinbase for example, have secured.

Regardless, American citizens continue to use the platform, despite not being KYC registered (and therefore put themselves at risk due to not having the necessary security requirements in place in case of an unfortunate event).

If KuCoin were to somehow be able to offer US customers KYC Registration, the exchange would be a much safer platform for all international issues. Not forgetting, the peer-to-peer trading options are also only currently available to those who have completed their KYC verification process.

That said, KuCoin does have a fantastic selection of competitive trading fees (lower than Coinbase and other exchanges), alongside volume discounts, and multiple advanced features, including margin trading and mining.

However, as with all exchanges, users must do their due diligence before deciding whether or not KuCoin is a suitable platform for their needs.