Coinbase Exchange

Coinbase Review 2023: An Expert's Comprehensive Analysis

4.1

5

2

5

4.5

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

Operational in many countries

Good security

Partnered with banks, so more universally accepted

Cons

Expensive fees on main app

No Directly accessible Proof of Reserves

Key Takeaways

Origins

Introduction

When it comes to cryptocurrency exchanges there are few as well known and respected as Coinbase.

An old hat in the space, it has grown steadily in the decade since its original inception to become one of the most widely used services in the whole of DeFi, serving hundreds of different countries and millions of users.

CEO Brian Armstrong founded Coinbase in June of 2012. Brian Amstrong is a well known Businessman, investor, and Billionaire in the US. Coinbase was certainly his biggest success yet however, and he is still very much involved with the company over a decade later after it's establishment.

Praised for its simplicity and reach, its slow ascendance to the pinnacle of the industry has made the company the subject of much discussion.

But is it worth using and what are the potential pitfalls? Join CoinScan as we dive deep into everything you need to know about Coinbase.

History

Due to its age, Coinbase has a rich and colorful history that is so jam-packed it could easily fill an entire article in and of itself – so we are politely rolling out the 'cliffnotes':

Coinbase was founded in June 2012, a year that saw altcoins start to enter the ring alongside the original trendsetter, Bitcoin. The exchange was created by Brian Amstrong, a then 29-year old American entrepreneur, who had previously worked as an Airbnb engineer.

The company itself took its household name from ‘coinbase transactions,’ which is a specific type of function that introduces crypto into circulation through a proof of work process.

After getting a $150k cash injection from an incubator program, he was joined shortly afterwards by co-founder Fred Ehrsam, who noticed Brian’s Reddit posts, outlining his ideas.

There was actually meant to be a third member of the founding team also – British programmer and Blockchain.info creator Ben Reeves – but he tapped-out not long after funding due to conflicting ideas on how the Coinbase wallet should operate.

In October 2012 Coinbase launched its service to buy and sell Bitcoin through bank transfers, but it was in May 2013 that things really got going, after the company landed $5 million in a Series A investment injection from Union Square Ventures.

At the end of the same year, they received a further $25 million from a number of additional investment firms, as well as hiring their first official employee – Forbes’ 30 under 30 Olaf Carlson-Wee.

The company didn’t show any signs of slowing down the following year, when they grew their users to over 1 million, purchased both web bookmarking company Kippt and blockchain service Blockr, as well as partnering with some of the tech big boys, such as Dell, Expedia and Time Inc, who all then allowed the use of Bitcoin to pay for their products and services – making Coinbase one of the pioneers of Bitcoin as a viable payment source.

Good work, Coinbase.

Another $75 million investment cycle in 2015 – which included several banks – the company continued to grow in dominance and reach, and in 2017 they received a BitLicence to trade in altcoins such as Ethereum and Litecoin.

2018 got seriously busy for the company; by March 2018 they had added support for numerous ERC-20 tokens as well as forming Coinbase Ventures with the sole focus of incubating and supporting promising new cryptocurrency projects.

In May a trading exchange they had previously created for professionals in 2015 (GDAX) was rebranded as Coinbase Pro; and they also launched Prime – a platform designed for institutional customers. Finally, in September 2018 they formed a consortium known as Centre (which also included two other companies – Circle and Bitmain) and launched the USD-pegged stablecoin, USDC.

Coinbase continued to grow in strength year-on-year, constantly adding new users, new tokens, and streamlining its service to make it more user-friendly as crypto adoption grew. At the time of writing the company now has 3730 employees worldwide and operates in over 100 countries.

User Experience

Ease of Use and Design

Coinbase is celebrated for both its ease of use and streamlined design - particularly on its general app, which is used by most retail traders. It effectively breaks down into two different versions of its service, Coinbase and Coinbase pro.

The former is less of an exchange per se, and more like a cryptocurrency brokerage featuring purchasable assets with an attached wallet, whereas the latter is a full exchange with trading pairs and advanced options, such as margin trading, time in force order, and limit orders (but no futures trading).

It is important to note that in 2023 Coinbase phased out the 'Pro' version of it's app in favor of having a 'simple' and 'advanced' trading mode on it's regular platform instead.

To access the platform – like nearly all centralized exchanges – both versions will require new users to complete a full Know Your Client (KYC) verification, including ID submission and facial identification, but it is a simple process taking on average around twenty minutes from start to finish – and much of this time is spent waiting for approval.

One of the notable benefits of the streamlined Coinbase app is its connection to PayPal, which allows direct withdrawals. This feature alone became a godsend to many individuals – particularly those within the UK in 2021 – when the vast majority (now rescinded) suddenly blocked direct withdrawals to customer accounts.

The cited reason was that they felt cryptocurrency was ‘unstable’ and represented a ‘threat to their customers,’ which due to their non-issue with other volatile exploits such as gambling, many citizens read it more as ‘a threat to us.’

Coinbase Pro is far more complex from a useability point of view, as it is effectively just GDAX rebranded, and as such is designed for advanced users. That said, in terms of navigation and ease of interaction, many believe it to be superior to its leading contemporary, Binance.

In terms of interface, the standard Coinbase is a delight. Created by popular San Francisco based design company, Moniker, its vivid blue and white color scheme, coupled with its stripped-down stylisation, make it extremely easy and fun to use.

Coinbase Pro on the flip-side is a far more standard affair, with typical black background, and the green and red charts that most have come to expect from exchanges – although most will be hoping to see more green than anything.

Usage and Popularity

When it comes to popularity and usage, Coinbase is one of the biggest out there. However, there are actually major inconsistencies when it comes to the exact numbers of people using the platform.

Coinbase itself states on its own website that it has over 108 million active users, which vastly contradicts a number of other sites, who put it closer to 14 million.

If Coinbase is to be believed then that would place its number of users at over 3 times that of Binance - the largest cryptocurrency exchange in the world. Take from that what you will.

Regardless of its actual user numbers, it certainly packs clout when it comes to volume, hitting roughly $1.4 billion per day in volume, with its BTC / USD pairing taking up large chunk of that at $442 million – although its absolute peak came back in the glorious 2021 bullrun, where it hit over $11 billion on Monday May 7.

Annually the company generates an impressive net income of $3.62 billion, with its volume a touch over $5 billion as of September 2022 – not bad numbers considering the cold crypto winter the industry is still trying to thaw out of.

Coinbase has a pretty healthy number of coins available on its Pro site, sitting at 245 tradable assets across 479 pairings. Just like Binance, Coinbase is always keeping a keen eye on the cryptocurrencies that are on it's system, and is no stranger to removing them for a variety of reasons.

In terms of coverage Coinbase has managed to venture beyond most of its peers, operating in a total of 107 countries (including the US, which has been a sticking point for many other exchanges).

Coinbase even managed to pull an Uno Reverse card and get Singapore – a staunch advocate against cryptocurrencies – to alter their decision banning their service, and have since begun trading there in November of 2023.

Customer support

Ten out of ten for Coinbase here. They have a very useful help section that covers everything from setting up an account, to trading basics, and even information regarding paying taxes on crypto.

Add to this a dedicated education section for those wanting to learn more about cryptocurrency, a direct support email and a fabled 24/7 customer support line that customers can access worldwide, and the company thoroughly earns its top marks. Coinbase is one of the few exchanges on our list that has a public phone number for customer support. This alone makes it a gem amongst all other exchanges, as this is an incredibly rare commodity in the cryptocurrency exchange world. Coinbase also offers support via it's twitter account, which you can conveniently DM (direct message) here. In an industry filled with great technology but lackluster support for customers around the world, everyone would do well to take a page from Coinbase's book when it comes to customer support.

Fees and Promotions

Fees

Fees are where the shine of Coinbase rubs off a little, as it is undeniably one of the more expensive exchanges, particularly when using its regular app version.

Their fee structure is also mind-bogglingly confusing and Coinbase doesn’t help matters by not publishing all of its fees, meaning users have to rely on third party information from multiple sources.

Luckily we have done all the hard work:

On the regular app, users will either pay a flat fee per buy or sell or a variable percentage of the transaction depending on the region, product and payment method. The flat fees for withdrawals for example are between $0.99 - $2.99 up to $200, but once that threshold has been broken, the rate switches to variable, which is between 1.49% and 3.99% depending on the method of withdrawal.

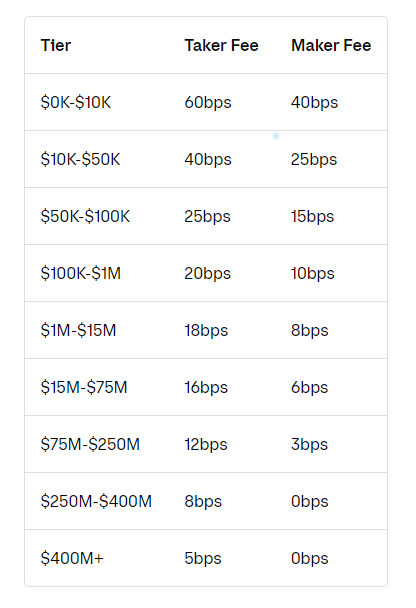

For spot trading, the platform uses a maker-taker fee model and are based upon the trader monthly trading volumen. For the initial pricing tier, based on a trading volume of $10,000 or less over the trailing 30-day period, maker fees are set at 0.60%, while takers are charged a 0.40% fee.

There is also a spread fee (the difference between the current market price for that asset and the price you buy or sell that asset for) of typically 0.5% of the transaction value – and absorbed into the quoted price.

That doesn’t even include the bank's own processing fees that can either be around 3% or a flat fee of $25 depending on region. This means that if selling $300, the fees could – in the worst case scenario – end up costing over $38!

Definitely no bueno.

To avoid these exorbitant fees it is far better to use Coinbase Pro. It applies the same model for trading fees. On transactions less than $10,000, users pay a very reasonable taker fee of 0.60% and maker fee of 0.40%.

When it comes to margin trading, Coinbase charges a fixed, annualized interest rate of 8% for both open and filled orders.

Although interest is only charged for hours in which the individual uses margin.

In regards to withdrawing, Coinbase Pro is once again champion, with no fee to cards or bank (although processing fees still apply).

These discounts extend to using the Coinbase card, where purchases using the regular site (including ATM withdrawals) will incur a 2.5% fee, compared to zero fee when using Coinbase Pro.

Considering a user has access to both of these services when signing up to either, it is definitely worth considering learning how to use the latter, as the cost implications quickly add up.

Comparison

Coinbase is one of the leading crypto exchanges in the US, arguably it can be considered responsible for on-ramping the massive amount of new crypto users / holders we saw back in 2020. Their mobile app is extremely intuitive, user friendly, and straightforward, and largely what helped facilitate that mass adoption. A direct competitor that comes to mind similar to Coinbase would be Binance US. These are arguably the two largest players in the US cryptocurrency market. Binance US does not have nearly the volume that Coinbase has however, with the former boasting a respectable $295 million compared to Coinbase's $1.3 billion. Coinbase also doesn't stop impressing there, as it has 231 cryptocurrencies available, one of the larger varieties we've reviewed across the board, compared to Binance US's 146, there are a lot more choices and opportunities over on Coinbase compared to most exchanges! Coinbase falls in comparison to many exchanges in few regards, but more commonly it's the fees section. Coinbase has some of the most expensive fees in the industry, understandable when you have such a strong platform that essentially onboarded the entire 2020 bull run, there are few platforms like it that have mastered the ability to simplifiy crypto so that anyone could buy. This of course comes at a cost, and Coinbase has fees that on average are 6x higher than Binance US's. This does not include the fact that Binance US does not charge any fees for Spot BTC trading. Ultimately, as is the story with most Crypto veterans, everyone usually starts off on Coinbase. The amazingly simple yet detailed platform allows almost anyone on the planet to purchase cryptocurrency and trade it with ease. If you don't mind paying the fees on smaller transactions (beginners) it's the perfect platform. For larger investors and more dedicated Crypto Enthusiasts, the fees will likely eventually push you away to other platforms that will save you money long term.

Safety Essentials

Security

Simply put, Coinbases’ security is among the best in the business. For starters they send a very clear message that “your crypto is your crypto” and don’t loan or take any other action with a customer’s assets without their express permission – which is very welcome news after the FTX scandal.

They also use multifaceted risk management programs and state of the art encryption to help protect customer assets, but for privacy, user data is only collected for the aforementioned protection, and the company is fully transparent with how it’s used.

Coinbase has a 24 / 7 security team, that just like Binance, that flags any irregular user activity, and the company employs numerous added security features such:

A key feature that sets it apart from the competition is its crime insurance, which whilst not issued by the Securities Investor Protection Corporation (SIPC) protects ‘some’ digital assets (with no specific amount given) from theft and cybersecurity breaches.

This does not typically cover crime on personal accounts such as through scamming or phishing attacks, unless the account is in the UK, in which the individual may be eligible for up to $/£150,000 reimbursement

Showing how insurances can be necessary and that no crypto exchange is truly safe, Coinbase was affected by a widespread phishing attack that coupled with some clever 2 factor authentication magic tricks cost some 6000 customers their crypto.

It is important to note that according to Coinbase, not only did they make fixes to ensure that the scam could not be repeated, but also reimbursed the victims in full.

Controversy

When it comes to cryptocurrency, controversy seems to come with the territory. That said, despite its age, Coinbase appears to have managed to keep its head held high, with only a few issues to speak of that were big enough to be largely reported, and most of them happening this year:

In 2020 the company came under a media firestorm when CEO Brian Armstrong published a personal blog post, which urged employees to refrain from entering into any political discussions in the workplace and offered compensation exit packages for those who wished to leave the company rather than toe the line on that particular policy. This came in the wake of a mass walkout after the CEO refused to respond to a question about the Black Lives Matter campaign during an internal Ask-Me-Anything meeting. Around 5% of the workforce departed.

It's important to note that generally speaking, when a company chooses to not focus on political statements or agendas when the business itself has nothing to do with politics, generally its a sign the company is focused on it's main objectives.

In July of this year, the exchange tackled a report that it had been selling the US Immigration and Customs Enforcement (ICE) specific tools to aid tracking and identifying crypto users, and was planning to do the same in Europe.

It is important to note that these were just allegations at the time.

Coinbase vehemently denied the allegations, tweeting that

We want to make this incredibly clear: Coinbase does not sell proprietary data” and that their tracer tools were “designed to support compliance and help investigate financial crimes like money laundering and terrorist financing.

Which seems fair enough.

Coinbase stock plummeted in August of this year after it was announced that there was a federal investigation regarding the possible sale of unregistered securities.

It is important to note many exchanges have been subject to the same investigations, and as yet, no official charges have been levied against the company.

In September, one of Coinbases’ product managers (as well as his brother and friend) were arrested for insider trading. During the trial, the brother Nikhil Wahi admitted that he, Ishan Wahi and their friend Sameer Ramani had profited by making trades in both June 2021 and April 2022 based on confidential information about digital assets the company was planning to let users trade. Coinbase wore the cape in this particular controversy, actively sharing its internal investigation findings with prosecutors to aid the case.

Proof of Reserves

After the collapse of FTX, many exchanges vowed to do their best to be more publicly transparent with where user funds were and held in what assets.

Binance is a great example of this, displaying the aggregate info for all to see on both Coin Gecko and CoinMarketCap, among others.

Coinbase hasn’t released that information as such, but instead crafted a lengthy article which explains how the information can be accessed, (specifically through their quarterly financials).

In the same article they announced their 500k developer grant program to encourage novel ways to present this information, and reveal that they are working on a decentralized system that will require zero trust in any institutions to check it. This of course is impressive, but is a slight misdirection from the fact that a perfectly workable system already exists and is being used by other companies.

Conclusion

Coinbase has been around long enough to have thoroughly earned its stripes in the cryptocurrency world. It is simple, easy to use and very user friendly – particularly for new users. The fact that it is supported by many banks means that it is less likely to come under attack from centralized institutions, and it is one of the most universally accepted platforms in the world. It has a healthy selection of tradable assets, and both its security features and support leave many other exchanges in its dust. In contrast there is a fair bit of mystery in terms of its actual user numbers, and by far the biggest sticking point for the company are its frankly extortionate and confusing fees on the base version of the app, making it a poor choice for anyone but absolute beginners or small traders. That is why CoinScan recommends that users take advantage of the handy educational tools Coinbase offers and learn the ropes quickly, so that they can benefit from the drastically reduced fees present on its Pro site – which doesn't require jumping any additional hurdles to access.