Huobi

HTX Review 2023: An Expert's Comprehensive Analysis

4.1

4

3.75

4.25

4.25

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

Great coverage in multiple countries

Registered in China, South Korea and Japan

Offers a wide range of cryptocurrencies

No past hacks - strong security measures

Good liquidity and volume on popular trading pairs

Offers leverage and advanced trading

Cons

Not available in the US

Questionable relationship with the Chinese government

Wash trading accusation

Not beginner friendly

Key Takeaways

Origins

Introduction

HTX, which was originally called Huobi up until September 2023, is a Chinese digital currency exchange that has operations in South Korea and Japan.

Despite questions frequently being raised about the exchange’s relationship with the Chinese government, the company remains a popular choice due to having deep liquidity in popular trading pairs – making it one of the most liquid cryptocurrency exchanges in the world.

Users can easily buy and sell digital currencies on the platform, even when there is a large amount of trading activity. The high level of liquidity on HTX also makes it an attractive platform for traders and investors, as it allows them to quickly and efficiently execute trades.

It is worth noting that the platform can be a little tricky for beginners to navigate, so this also highlights it's appeal to a more experienced and professional clientele.

Another perk includes its generous amount of coins and trading pairs. Sounds faultless right? Well not so fast – join us as we dive deep into HTX and see if it can hold up to CoinScan scrutiny.

History

HTX is a digital currency exchange that was founded in China in 2013 by Leon Li, a computer engineer who previously worked at Oracle and OKCoin.

In the early years of its operation, HTX quickly became one of the largest and most popular cryptocurrency exchanges in China. The company was initially headquartered in Beijing, but it has since expanded to operate in multiple countries around the world.

However, the exchange faced regulatory challenges in 2017, when the Chinese government implemented a ban on initial coin offerings (ICOs) and restricted trading in cryptocurrency.

In response, HTX began to shift its focus to international markets and established operation centers in Hong Kong, South Korea, Japan, and the United States. Its headquarters are currently located in the Seychelles islands.

Since its founding, HTX has continued to expand and diversify its business. In addition to its core exchange services, the company now offers a number of other products and services, including:

HTX has also made a number of strategic acquisitions and partnerships in order to expand its reach and capabilities. Today, HTX is considered to be one of the leading cryptocurrency exchanges in the world, with a large user base and high trading volume.

User Experience

Ease of Use and Design

HTX has a very friendly user interface, and is relatively easy to use compared to many of its contemporaries.

It’s not too overwhelming for new users, but has enough advanced options that those familiar with the proceedings will be able to dive straight in and get going.

Visual elements are arranged in an intuitive manner, making it easier for users to monitor market trends, execute trades, and manage their portfolios on the platform with relative ease.

The platform's design demonstrates a balanced fusion of aesthetic appeal and functionality, ensuring that users can efficiently carry out transactions while enjoying a streamlined interface. In addition to it's design, HTX offers a variety of resources, including tutorials and FAQs, to help those still finding their feet to get going, adding another bonus point for users who are new to the crypto space to make this their go-to exchange.

Usage and Popularity

HTX has a large user base and high trading volume, making it a popular choice. According to data from CoinMarketCap, HTX is consistently ranked among the top 11 cryptocurrency exchanges by trading volume, with a particularly strong presence in Asia – boasting over 10 million users.

As of the time of writing, there are approximately 604 coins and 691 trading pairs available on HTX . This gives users a wide range of options for buying, selling, and trading digital currencies.

Following this, HTX is a highly active exchange in terms of trading volume. The 24-hour trading volume on HTX is currently around $328,678,597.86. The most active trading pair on the platform is BTC/USDT, with a 24-hour volume of $50,597,314.00 on average.

Additionally to other core exchange services, HTX's offerings contribute to its popularity. The digital asset custody service is well-received by users, as it provides a secure and convenient way to store digital assets. Above is a screenshot of their rates for those interested.

Digital asset lending remains a popular feature of the exchange as well, it allows users to earn interest on their digital assets by lending them out, as is the cryptocurrency index fund, which allows users to gain exposure to a diversified portfolio of digital assets.

Like many other exchanges, HTX also has its own exchange token (dubbed $HT), which is currently valued at an impressive $5.37 on a $2.6 billion fully diluted market cap, and serves as a utility token within the HTX ecosystem.

Users can use it for paying for fees such as trading, withdrawal, and listing on the exchange, and holders are entitled to discounts on these fees as well as the ability to participate in voting and decision-making within the HTX community. It is also tradable on various cryptocurrency exchanges and can be stored in a digital wallet compatible with the ERC-20 standard.

It’s important to note that another aspect which makes HTX a popular choice includes offering an insurance fund to help cover losses or resolve issues related to digital asset contract trading. This insurance fund is specific to each digital asset contract and is also shared among different periods of the same contract.

Customer Support

HTX is known for having a strong customer support team that is dedicated to helping its users. The exchange offers a range of support options for its users, including an online knowledge base, email support, and a customer service online chat.

HTX stands out for offering the holy grail of support – a 24-hour online chat for users to contact in case of any issues or concerns. HTX's commitment to providing quick, real-time assistance to its users demonstrates its dedication to prioritizing security and customer support.

If for some reason users want to use an alternative channel, they can access the online knowledge by visiting the HTX website and clicking on the "Support" tab. The knowledge base contains a range of helpful articles and resources on topics such as account management, security, and trading.

Users can also use the search function to find specific information or answers to their questions if they are simpler.

In addition to the knowledge base, HTX also offers email support for users who need additional help or have more specific questions. Users can contact the customer support team by emailing them through the "Contact Us" form on the HTX website. The team typically responds to email inquiries within 24 hours.

Overall, HTX's customer support team is known for being responsive, helpful, and knowledgeable, so can’t be faulted.

Fees and Promotions

Fees

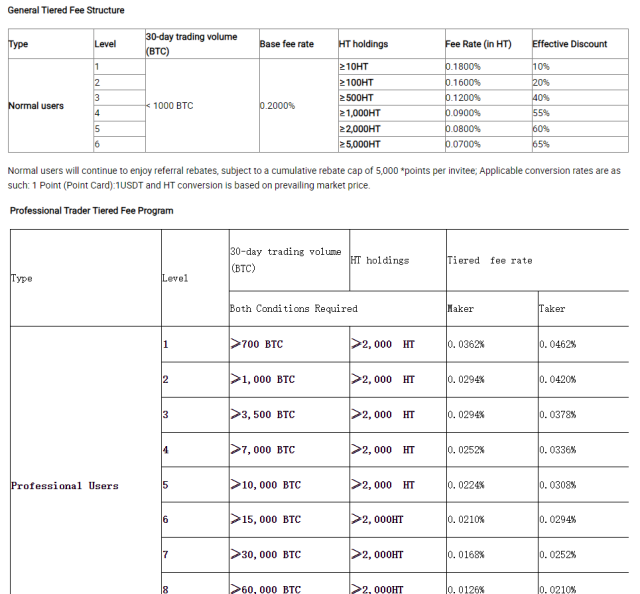

HTX charges fees for its services, including fees for trading on the exchange and for using some of its other products. The specific fees that HTX charges can vary depending on the type of service being used and other factors.

HTX charges a base fee of 0.20% for spot trading. For margin trading, which allows users to borrow funds in order to trade with leverage, the interest rates are calculated on an hourly basis. This means that if the daily interest rate is 0.098%, the hourly rate would be 0.0041% (0.098% divided by 24 hours).

It's important to note that even if you borrow funds for less than an hour, the exchange will still charge the interest rate for a full hour.

In addition to trading fees, HTX charges fees for using its digital asset custody service, which provides a secure way for users to store their digital assets. These fees can vary depending on the type of digital asset being stored and the level of security and insurance provided.

HTX also charges fees for its digital asset lending service, which allows users to earn interest on their digital assets by lending them out.

Comparison

Both Huobi and OKEx originated in China and quickly rose to prominence as two of the country's leading cryptocurrency exchanges. Their establishment in the early 2010s allowed them to capitalize on the burgeoning interest in cryptocurrencies, especially within the Asian market.

As comprehensive platforms, they offer a plethora of services including spot trading, futures contracts, margin trading, and staking options. Both exchanges emphasize strong security measures, such as cold storage, encryption, and two-factor authentication, to ensure user assets are safeguarded.

Additionally, in response to regulatory pressures from the Chinese government, both have strategically expanded their operations to cater to a broader global audience.

While they share foundational similarities, Huobi and OKEx have distinct characteristics and operational approaches.

Huobi, since its inception, has positioned itself as a bridge between the traditional financial world and the emerging digital asset universe, focusing heavily on regulatory compliance. This approach has allowed it to establish a strong foothold in several international markets, making it seem more transparent to certain investors.

On the other hand, OKEx has been more aggressive in product innovation, often being one of the first to introduce new trading products and services, such as unique derivative products.

Moreover, OKEx's native token, OKB, plays a pivotal role within its ecosystem, offering users a myriad of benefits similar to Huobi's HT token but with some distinct utilities and use-cases.

Safety Essentials

Security

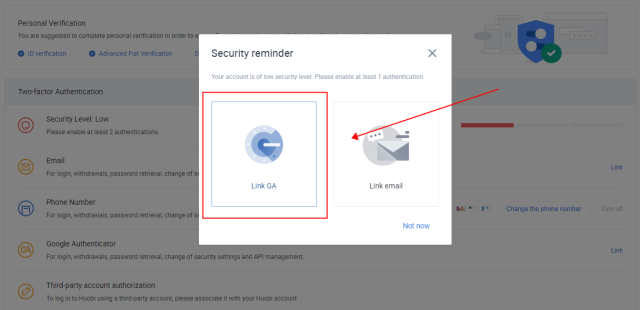

HTX is a digital currency exchange that places a strong emphasis on security in order to protect the platform and its users. The exchange has implemented a number of measures to ensure the safety of its users' assets and information.

One key aspect of HTX's security is the use of cold storage for the majority of its digital assets. Cold storage refers to the practice of storing digital assets offline, in order to reduce the risk of theft or loss during an online attack.

In addition to cold storage, HTX also includes two-factor authentication (2FA) for account login and withdrawal, as well as advanced security protocols and encryption technologies.

These measures help to prevent unauthorized access to user accounts and protect against potential threats such as phishing attacks or malware.

HTX also has a dedicated security team that is responsible for monitoring the platform for potential threats and working to prevent security breaches. The team is constantly monitoring the platform and working to identify and mitigate any potential vulnerabilities.

All in all, it has rather strong security measures in place, therefore, a good reputation for security and is considered to be a reliable and secure platform.

Controversy

Like Gemini, HTX is one of few exchanges that has not suffered any major security breaches or hacks. However the site doesn’t smell totally of roses and has been the subject of some controversy.

Most of its central issues revolve around its shaky issues with China and its government. After being founded in China, the company was initially focused on serving the Chinese market.

The Chinese government has historically taken a stricter approach to cryptocurrency regulation, and HTX faced some challenges as a result, but this does not mean that this is due to any wrong doing on their part.

As mentioned earlier, in 2017 the Chinese government implemented a ban on initial coin offerings (ICOs) and began cracking down on cryptocurrency exchanges operating within the country. HTX was forced to halt operations in China and shift its focus to other markets.

Although on the complete opposite of the spectrum, another issue that has been raised about HTX is its relationship with the Chinese government. Some critics have accused the exchange of having close ties with the government and have raised concerns about the potential for government interference or influence on the platform.

Of course, HTX has denied these allegations and has stated that it operates independently of the government.

In addition, HTX also receives attention for not being available in the United States at all, although there are numerous reasons why this may be the case.

One reason could be regulatory issues: The United States has a complex and ever-evolving regulatory environment for cryptocurrency and digital assets, and exchanges must comply with a variety of rules and regulations in order to operate in the country.

HTX may have chosen not to enter the US market in order to avoid the additional compliance costs and risks associated with operating in the country. Additionally the timing is not ideal considering the current bear market and layoffs HTX had to do earlier in 2023.

Another reason could be business strategy. HTX may have decided to focus on other markets or regions where it sees greater potential for growth. However, there are rumors that HTX is working to obtain the necessary licenses and approvals to operate in the US, and plans to enter the market at a later date, so only time will tell there.

It's also worth noting that while HTX itself may not be available in the US, it is possible for US-based investors to access the platform through a cryptocurrency exchange that does offer HTX trading.

Proof of Reserves

HTX has implemented a number of measures to ensure the security and integrity of its platform, including a proof of reserves system. Proof of reserves is a process in which an exchange demonstrates that it holds the assets that it claims to hold.

This helps to ensure that an exchange is operating in a transparent and trustworthy manner, and that users' assets are safe and secure.

To demonstrate its proof of reserves, HTX publishes regular reports on its website that detail the assets it holds and the liabilities it owes to its users.

These reports are audited by a third-party accounting firm, which helps to ensure their accuracy and independence. By publishing these reports and undergoing regular audits, HTX is able to demonstrate that it is holding the assets it claims to hold and that it is operating in a transparent and trustworthy manner.

Overall, HTX's proof of reserves system is an important aspect of the exchange's commitment to security and transparency. It helps to ensure that users can trust the exchange and have confidence in the safety of their assets.

Conclusion

In conclusion, HTX is a digital currency exchange that has become a major player in the cryptocurrency industry, despite being a little tricky for beginners.

One of its major perks is that it has high liquidity – an especially important aspect for traders who want to be able to enter or exit a position quickly and at a competitive price.

In addition, HTX offers a range of other features attractive to cryptocurrency traders. These features include a variety of trading tools and analysis resources, and a wide selection of cryptocurrencies to trade. Its strong reputation for security and reliability is also an important consideration when choosing an exchange.

Although HTX has faced some controversy in the past, including its questionable relationship with the Chinese government, the exchange has demonstrated its commitment to operating in a responsible and transparent manner and has taken steps to comply with local laws and regulations, with there being no notable issues as of yet.

Overall, HTX operates fantastically and has established itself as a trusted and respected brand in the cryptocurrency industry. Following this, it has a particularly strong presence around the globe and especially Asia worth boasting about. Now, we just want to see Americans getting involved!