How to Master Token Sniping with Banana Gun Bot

- What is Banana Gun?

- How to Start Using Banana Gun? First Time Users Guide

- Banana Gun Bots Features

- Fee Structure

- $BANANA Token

- The Risks of Telegram-Based Crypto Trading Bots

- Conclusion

In the ever-evolving landscape of DeFi trading, innovative tools are constantly shaping the future of cryptocurrency transactions. Among these, Banana Gun Bot stands out as a transformative force, offering traders unparalleled advantages in the competitive market.

Banana Gun's debut has completely shifted the way traders interact and transact on the blockchain, and has positioned Banana Gun as the number 1 bot on the market in terms of functionality and volume! Let's delve into what makes this bot a game-changer in the realm of digital finance.

What is Banana Gun?

Banana Gun Bot emerges as a groundbreaking Telegram-based tool designed for cryptocurrency trading in Decentralized Finance (DeFi) space. It simplifies transacting with decentralized exchanges (DEX), providing an optimized, integrated interface that allows users to perform trades directly through the Telegram chat platform.

At its core, Banana Gun specializes in sniping token launches, providing a strategic edge in securing positions in new tokens right as they hit the market. Beyond its primary function, the bot extends its utility through features like manual buying, robust anti-rug mechanisms, and innovative solutions for optimizing trade efficiency and security.

The bot stands out for its adaptability to the Ethereum network, with plans to extend support across additional blockchains in the future. Banana is making headlines lately for already supporting Solana and Base chain, two prominent alternatives to DeFi trading besides Ethereum.

Aimed at revolutionizing the way traders engage with upcoming and live tokens, Banana Gun positions itself as the premier choice for users looking to enhance their trading strategies on Ethereum and beyond.

As stated in its documentation, Banana Gun consists of three distinct bots: one dedicated to user registration, another designed for executing both manual and automatic crypto purchases, and a third focused on the sale of cryptocurrencies.

How to Start Using Banana Gun? First Time Users Guide

Sign up for an account on Telegram.

Press the 'Start' button and then select the 'Create Wallet' option. You have the choice to either import an existing wallet or create a new one. For this guide, we will proceed with creating a new wallet. (Recommended)

Name your wallet.

You will receive your private key and public address. It's crucial to keep your private key in a highly secure location. After saving your information, we recommend deleting the message to ensure there is no online record of your private key.

Your Banana Gun Bot is now ready for use!

Banana Gun Bots Features

Auto Sniper

Banana Gun Bot allows users to automatically purchase new tokens as soon as they are launched on the market, aiming to take advantage of early prices for potential profit.

How to Set Up a Snipe with Banana Gun Bot?

Execute the /start function and select the "Auto Sniper" option.

Paste the contract address you want to snipe.

Specify the amount to spend per wallet, the auto sniper tip amount, and the number of wallets you intend to use. You can either respond with each amount separately or enter 'amount to spend/auto snipe tip/number of wallets' directly in a single response. ex: 0.1/0.01/2 Amount to spend = 0.1

Auto snipe tip = 0.01

Number of wallets = 2

That’s it! Your snipe will be set.

Snipe Overview

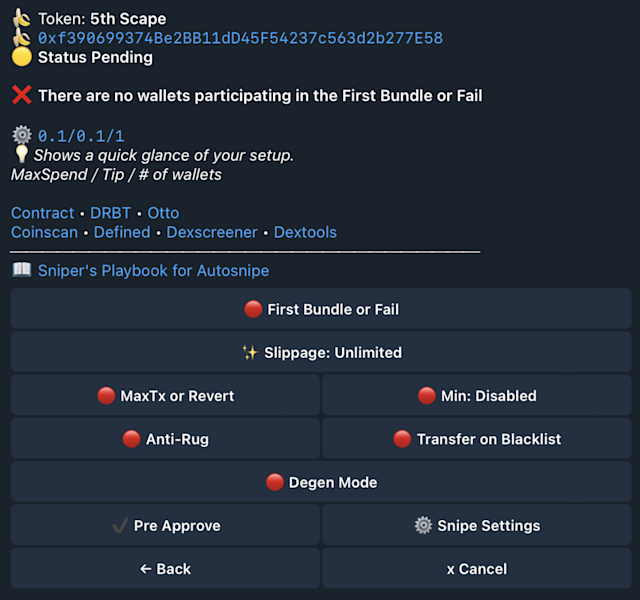

After setting the snipe you will be able to see its current status and settings.

Name and contract address of the token you select to snip.

Snipe Status.

Information about other wallets participating in the First Bundle or Fail (FoF): Banana Gun shows how many wallets are 'aimed' at a token before launch. On tokens with a lot of pre-launch attention, they can get pretty competitive when it comes to the 'auto snipe tip' which is essentially a bribe for validators on the network to process your transaction before others. Based on the estimation given by Banana Gun, always adjust your auto snipe tip, for example, if Banana Gun shows more than 30 wallets are aimed at a token, you will probably need to 'tip' at least 0.1 ETH to get a good placement on the block. On token launches with a lot of buying pressure at launch, it's not uncommon to see users tipping 0.5 ETH or even multiple ETH just to get in before everyone else, so make sure you study how bribing works before attempting snipes on highly anticipated tokens.

The main information of the snipe: amount to spend per wallet/auto snipe tip number of wallets used.

Snipe Settings

First Bunde of Fail (FoF): Once activated, Banana Gun strategically targets the initial purchase when the trading starts, aiming for the first transaction block.

Slippage: The slippage feature supports a flexible range from 0 to 99%, designed for token launches that do not impose a limit on transaction sizes. It's important to note that Banana has anti-mev built into the bot, so most users leave their slippage at 99% to ensure buying tokens goes smoothly and minimizes failed transactions.

Manual Buying

Buy coins like you normally would in the DeFi space, but more faster and easier with the Banana Gun Telegram interface.

How to User Manual Buyer feature in Banana Gun?

Execute the '/start' function in the bot and select the "Manual Buyer" button. (You can also bypass this step by simply pasting the contract directly into the chat)

Paste the contract address you want to buy.

A token overview will appear along with different buy option amounts. You can edit these options by clicking the Settings option, or selecting the 'Buy X' button to input a custom buy amount.

Once the purchase is successful, you will get a confirmation message and the Sell bot will message you with an updated window of your current position and sell options for the token.

Anti Rug

The Anti-Rug feature in Banana Gun Bot is designed to protect users during token sniping operations. When enabled, this function monitors for signs of a rug pull, such as sudden increases in transaction taxes or actions by the developer that would prevent investors from selling their tokens. If such suspicious activity is detected, the bot aims to preemptively execute a sell order on behalf of the user, potentially safeguarding their investment from loss. This feature adds an additional layer of security for users engaging in the volatile activity of token sniping.

Private Transactions, Sandwich & Reorg Protection

The private transaction feature of Banana Gun Bot is engineered to safeguard users' trades by executing them in a manner that conceals the details from the broader network until the transaction is finalized. This is crucial in preventing predatory strategies like sandwich attacks (MEV), where opportunistic traders capitalize on pending transactions.

It provides users with an extra layer of security by privately executing user-set Ethereum transactions, ensuring these transactions are not only kept private but also receive priority in the network, mitigating the risk of being outmaneuvered by other traders or bots looking to exploit visible trades.

The private transaction feature not only lowers expenses in scenarios with high gas fees but also safeguards users against sandwich attacks, which manipulate the sequence of transactions to capitalize on high slippage trades. Banana Gun users can essentially trade worry-free because of this built-in functionality.

Fee Structure

Banana Gun employs a competitive low-fee model, charging only 0.5% on the gross amount for both buys and sells. Understanding the term 'gross' is key. For example, engaging in both buying and selling 1 ETH would result in fees of 0.005 ETH per transaction, totaling 0.01 ETH.

Banana Gun Bot fees are:

Manual buys and limit orders on Ethereum = 0.5%

Autosniper on Ethereum = 1%

Trades on other chains = 1%

The affordable transaction fees of Banana Gun Bot serve as a distinct benefit for cost-aware traders, offering an attractive choice to reduce expenses while enhancing trading tactics.

$BANANA Token

Launched on September 14, 2023, on the Ethereum blockchain, the $BANANA token powers the Banana Gun project as its native, fungible cryptocurrency. While primarily serving the community, the allocation to the team suggests that fundraising and profit generation also underpin the creation of the $BANANA token. This dual-purpose approach underscores its role in both community engagement and the financial sustainability of the project.

Moreover, the Banana Gun documentation outlines the vision for a long-term ecosystem energized by its tokenomics “where bot users become token holders and token holders become bot users”. This synergy aims to create a self-sustaining cycle, enhancing the project's sustainability and community engagement.

Tokenomics

The total number of tokens in circulation will be around 2.5 million, including liquidity. The token has no token taxes (0%/0% buy/sell tax) and no transfer tax.

The Risks of Telegram-Based Crypto Trading Bots

For the crypto enthusiast seeking a streamlined trading experience, Telegram bots offer a great solution to clumsy and complicated DEX swaps. However, these bots require access to your wallet to transact, so there is always a security risk when using them.

While developers often assure users that private keys are deleted after configuration, the opaque nature of these bots makes verification impossible. This lack of transparency necessitates a cautious approach. For those venturing into the world of Telegram crypto bots, a dedicated wallet with limited funds specifically allocated for trading through the bot is strongly recommended.

Conclusion

Banana Gun Bot has undoubtedly changed the DeFi landscape and brought powerful trading capabilities to everyday Joe's looking trade in a simple and user-friendly package. It's become a pivotal tool for traders aiming to dominate the competitive Block 0 battleground, contributing to numerous success stories.

Banana Gun Bot has rapidly grown its user base, even during tough market conditions, demonstrating the high demand for its capabilities. The commitment of its developers to continual improvement is crucial to meet the evolving needs of a discerning and dynamic user community.

Ex-crypto miner and crypto enthusiast since 2019.